Federal marginal income tax rates 2021

10 12 22 24 32 35 and 37. How Do Marginal Income Tax Rates Work in 2021.

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

The seven federal tax brackets for tax year 2021 set by the Internal Revenue Service were 10 12 22 24 32 35 and 37.

. Census Bureaus American Community Survey ACS 5-year estimates Table B27015. Data is from the US. Updated with tax rates for tax year 2020 due April 2021 Compare the tax year 2020 tax brackets above with the federal brackets for tax year 2019 below.

The table below shows the tax brackets for the federal. Federal Individual Income Tax Rates and Brackets. The United States federal tax laws follow a progressive tax system with 2019-2021 marginal tax rate varying from 10 to 37.

15 on the first 50197 of taxable income plus. Your Federal taxes are estimated at 0. Income in America is taxed by the federal government most state governments and many local governments.

The top marginal income tax rate. The Federal Income Tax is a. This elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

The data only includes the. 46 Income per Cap. In Nominal Dollars Income Years 1862-2021 Married Filing Jointly Married Filing Separately Single Filer.

Below are income tax bracket and rate tables. The 12 rate would be applied to your income that falls between 9950 and 40525 and the 10 rate is applied to. What is the federal tax bracket for 2021 in Canada.

205 on the next 50195 of taxable income on the portion of taxable income over 50197 up to 100392 plus. Your tax bracket shows the rate you pay on each portion of your income for federal taxes. The federal income tax system is progressive so the rate of.

The following are the federal tax rates for 2021 according to the Canada Revenue Agency CRA. 60 Recent Job Growth-33-62 Future Job Growth. Calculating Income Tax Liability For many individuals and families calculating federal income tax liability can be broken down into three.

For the tax year 2021 youd pay 22 on income over 40525. 0 would also be your average tax rate. LiveStories calculated the percentages.

The personal exemption for tax year 2021 remains at 0 as it was for 2020. Federal Tax Bracket Rates 2021. The federal income tax rates remain unchanged for the 2021 and 2022 tax years.

26 on the next 55233. If a familys total income is less than the. For the 2021 tax year there are seven federal tax brackets.

This is 0 of your total income of 0. In 2018 the federal poverty income threshold was 25465 for a family of four with two children and 17308 for a single parent of one child. Your filing status and taxable income such as your wages determines the.

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

2020 Federal Income Tax Brackets

2018 Irs Federal Income Tax Brackets Breakdown Example Married W 1 Child My Money Blog

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Understanding Individual Federal Income Tax Brackets Los Angeles Accounting Services Tax Preparation Business Consulting Hermosa Beach Ca Accountant

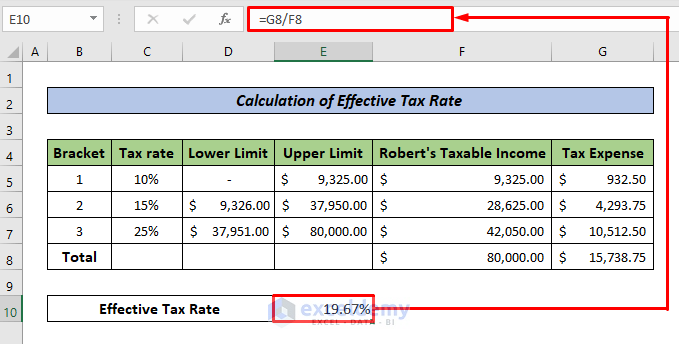

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Federal Tax Rate In Excel With Easy Steps

Federal Income Tax Bracket What Tax Bracket Am I In Br

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Personal Income Tax Brackets Ontario 2021 Md Tax

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Understanding Marginal Income Tax Brackets Silver Penny Financial